Tariff packages

"vseMINIMUM"tariff

Favorable tariff for entrepreneurs and small businesses

"vseMINIMUM"tariff

Favorable tariff for entrepreneurs and small businesses

- 10 free payments beyond FUIB

- 1 free card

- Free connection to the package

"vseOPTIMUM"tariff

Favorable tariff for active companies and entrepreneurs

"vseOPTIMUM"tariff

Favorable tariff for active companies and entrepreneurs

- Unlimited number of free payments up to 5 UAH thousand

- 2 free cards

- Free connection to the package

"vsePREMIUM"tariff

Unlimited business plan

"vsePREMIUM"tariff

Unlimited business plan

- Unlimited number of free payments up to 100 UAH thousand

- 2 free cards

- Free connection to the package

Financing

General credit limit

Loans for business needs

Overdraft to finance business activities in case of temporary shortage of own funds on the current account.

Get funding for your short-term business needs. It is a credit limit that is always at hand.

Partnership programs provide preferential lending for the purchase of goods from the bank's partners

Compensation for part of the interest rate on a loan, which reduces the client's rate under the agreement.

| Investment objectives: | 5-7-9% |

| Working capital: | 13% |

| Individual categories: | 3% |

Receive funds today and pay at the end of the year. The cost of funds is less than a bank loan.

Obtaining working capital to finance current business needs.

Deposits

Internet banking

|

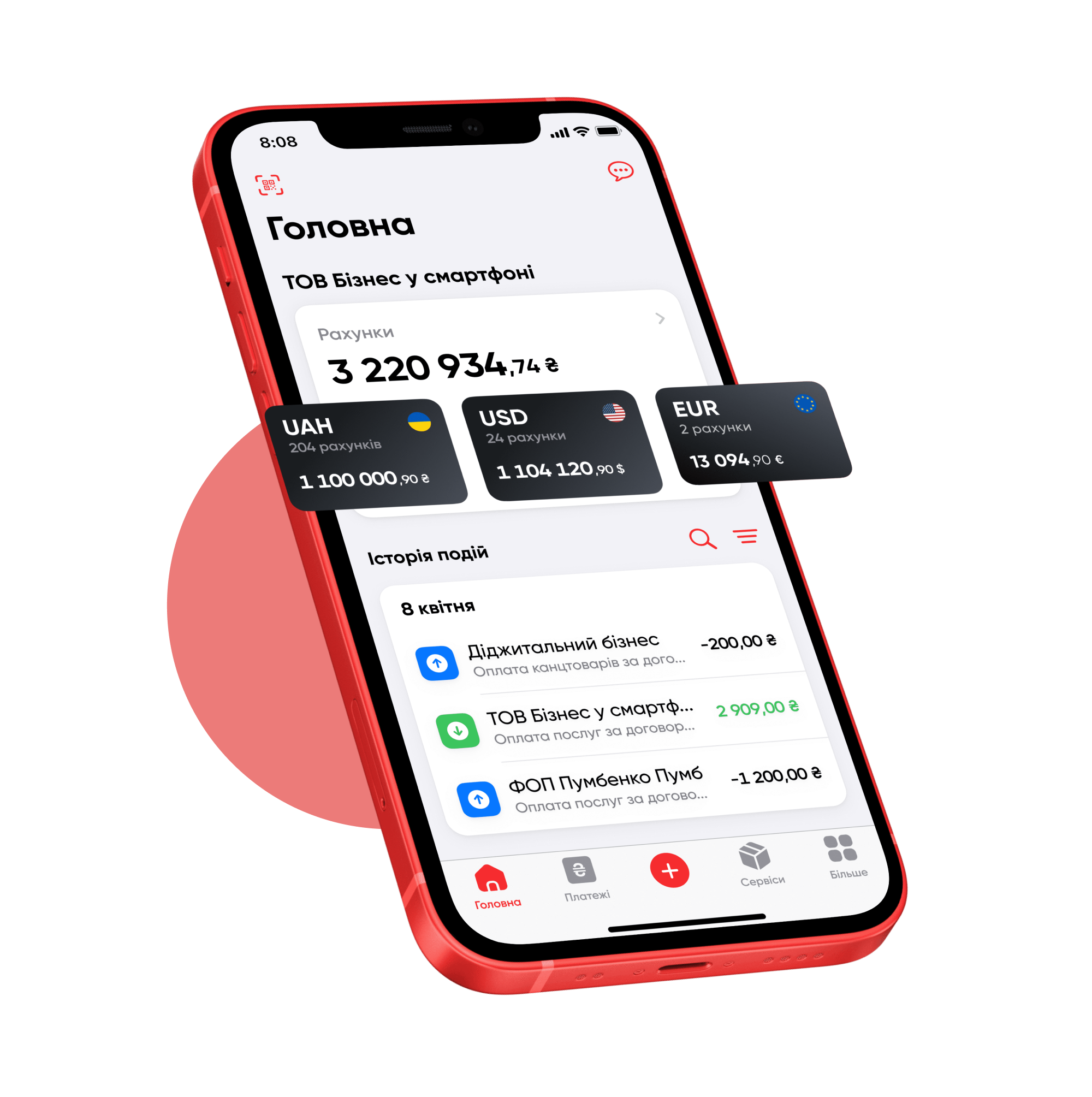

Mobile app

PUMB Digital Business is a mobile application for individual

|