en

You deliver goods and services on a deferred payment basis.

Do not limit your possibilities, use factoring from FUIB Bank and get:

Factoring is a set of financial services for manufacturers and suppliers conducting trading activities on a deferred payment basis.

JSC "FUIB" is a participant in the state business support program "Affordable Factoring", which provides for compensation of the interest rate under factoring agreements at a level of up to 13% per annum. The program is implemented by the Government of Ukraine through the Entrepreneurship Development Fund.

The advantages of factoring from FUIB:

Factoring financing terms:

You can choose:

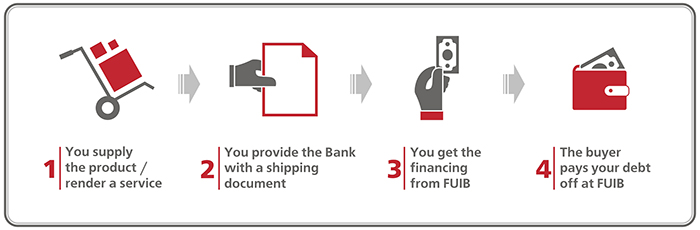

How does factoring work?

FUIB is a reliable partner

- TOP-1 in terms of factoring

- 40 of 100 largest companies in Ukraine trust us

The possibility of remote signing of documents to establish a factoring limit and further financing has been implemented.